Which are the best term life insurance and health insurance?

Comparing the Benefits of Different Term Life Insurance Policies

Term life insurance is a type of life insurance policy that offers coverage for a specific period of time. It is a popular choice for those looking for a cost-effective way to protect their family in the event of their death. When considering a term life insurance policy, it is important to compare the benefits offered by different policies.

Financial Protection for Your Family

The primary benefit of term life insurance is that it provides your family with a financial safety net in the event of your death. The money from the policy can be used to provide for your family’s needs, such as paying off debts, medical expenses, and other expenses related to your death.

Affordable Premiums

Term life insurance premiums tend to be more affordable than other types of life insurance policies. This is because the policy only covers you for a specific period of time. The amount of the premium is based on your age, health, and lifestyle, so it is important to compare policies to find the most cost-effective option.

Flexible Coverage Options

There are several different types of term life insurance policies available, so you can choose the one that best meets your needs. Some policies provide coverage for a specific period of time, while others offer coverage for the remainder of your life. You can also choose the amount of coverage that you need, depending on your financial situation and other factors.

Additional Benefits

Some term life insurance policies offer additional benefits, such as the ability to convert the policy to a permanent life insurance policy. This can be beneficial if you need more coverage in the future, or if you want to ensure that your family is financially secure in the event of your death.

Compare Policies Carefully

When comparing term life insurance policies, it is important to consider the benefits and features offered by each policy. You should also compare the premiums and other costs associated with each policy. By doing this, you can find the policy that best fits your needs and provides the most financial protection for your family.

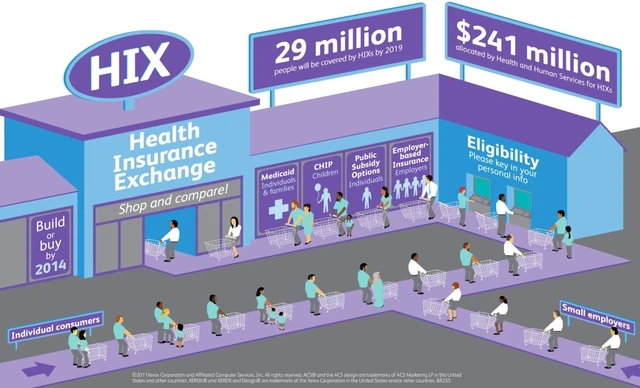

Understanding the Basics of Health Insurance and How to Choose the Best Plan

Health insurance is an essential part of modern life. It can help to pay for medical treatments and protect you from financial hardship in case of an accident or illness. With so many different types of health insurance plans available, it’s important to understand the basics of health insurance and how to choose the best plan for you.

What is Health Insurance?

Health insurance is a contract between a person and a health insurance company. The contract states that the health insurance company agrees to pay for all or a portion of the person’s medical expenses. Health insurance plans vary in terms of what services they cover, what portion of the costs they cover, and how much the person pays out-of-pocket. Some health insurance plans are offered through employers, while others are purchased directly from an insurance provider.

What Does Health Insurance Cover?

Most health insurance plans cover a variety of medical services, including doctor’s visits, prescription drugs, hospital stays, and preventive care. Some plans may also cover vision and dental care. It’s important to understand what services are covered by your health insurance plan, as well as any restrictions or exclusions.

Types of Health Insurance Plans

There are several types of health insurance plans, including Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), and High Deductible Health Plans (HDHPs). PPOs allow you to choose from a wide variety of doctors and hospitals and typically offer more coverage options than HMOs. HMOs usually require you to choose a primary care physician and will generally cover services only if they are provided by a doctor in the network. HDHPs usually have lower monthly premiums, but higher deductibles.

Choosing the Right Plan

When choosing a health insurance plan, you should consider your current and future health needs, as well as your budget. It’s important to understand the terms of the plan, including the deductible, copayments, and coinsurance, and to make sure that your preferred doctors and hospitals are included in the network. Before signing up for a health insurance plan, it’s a good idea to compare different plans and their costs to make sure you’re getting the best deal.

Exploring the Advantages of Combining Term Life and Health Insurance

Combining term life and health insurance can be a great way to ensure you and your family are financially secure. In this article, we will discuss some of the advantages of combining these two types of insurance policies.

Financial Security

One key benefit of combining term life and health insurance is that it can provide financial security for you and your family. If something were to happen to you, such as an unexpected illness or injury, the insurance policy would cover your medical expenses and provide a death benefit to your family. This can provide a significant amount of peace of mind, knowing that your family will be taken care of in the event of an emergency.

Affordable Premiums

Another advantage of combining term life and health insurance is that the premiums for both policies can be quite affordable. Many insurance companies offer discounts if you bundle both policies together, so you can save money and still get the coverage you need. This can be especially helpful for those who are on a tight budget.

More Coverage

When you combine term life and health insurance, you can get more coverage for both policies. For example, if you have a term life insurance policy, you may be able to add additional riders to the policy, such as an accidental death rider, which would provide additional coverage in the event of an accidental death. Similarly, if you have health insurance, you may be able to add additional riders to cover things like prescription drugs and vision care.

Convenience

Finally, combining term life and health insurance can be much more convenient than having separate policies. Instead of having to manage two different policies, you can just manage one. This can make it much easier to keep track of your coverage and make sure you have the coverage you need.

Tips for Finding the Most Affordable Term Life and Health Insurance Plans

Finding the best term life insurance and health insurance plans that fit your needs and your budget can be a challenge. But with a little research and some savvy shopping, it is possible to find an affordable policy that meets your needs.

1. Research Your Options

When you’re searching for an affordable insurance plan, it’s important to first understand what you need from your policy and compare different policies to see which one offers the best coverage at the lowest cost. Different insurance companies will offer different terms, so it’s important to research all of your options to make sure you’re getting the best deal.

2. Look for Discounts

Insurance companies often offer discounts for policyholders who meet certain criteria. For example, some life insurance policies may offer a discount for policyholders who are non-smokers or who have a healthy lifestyle. Similarly, some health insurance policies may offer discounts for policyholders who are enrolled in wellness programs or who use generic medications. Make sure to ask your insurance provider if they offer any discounts that you may qualify for.

3. Consider Bundling Policies

If you’re looking to save money on your insurance coverage, consider bundling your policies. Many companies offer discounts for policyholders who purchase multiple policies, such as life insurance and health insurance. Bundling your policies can help you save money while still getting the coverage you need.

4. Compare Quotes

When you’re shopping around for an insurance policy, make sure to compare quotes from multiple providers. Different providers will offer different rates and terms, so it’s important to compare quotes to make sure you’re getting the best deal. Comparing quotes can help you find an affordable policy that meets your needs.

5. Read the Policy Carefully

Before you purchase an insurance policy, make sure to read the policy carefully to make sure you understand the coverage you’re getting and any exclusions or restrictions that apply. It’s also important to check the policy’s cancellation policy in case you decide to cancel the policy in the future. Understanding your policy before you purchase it can help you make an informed decision and avoid any surprises down the road.

Finding an affordable term life insurance and health insurance plan doesn’t have to be a challenge. With a little research and savvy shopping, you can find a policy that meets your needs and your budget. Make sure to research your options, look for discounts, consider bundling policies, compare quotes, and read the policy carefully before you purchase a policy.